Originally build for military logistics, l’Arsenal building today serves as offices for commercial activities. Solar panels are installed on the roof of the building section owned by 2084 SA. It has a capacity of 100kWp and produces on average 920.000kWh every year. This production is intended to power industrial processes performed in the building by Delvaux SA.

Around 40% of the solar production is self-consumed by industrial activity on site, which significantly reduces the energy bill at the end of the month. The other 60% is injected in the electrical grid and purchased by an energy supplier under a classic injection contract valuing injections at the spot price.

The situation has changed significantly for Solar PV owners, do you share this observation?

Indeed, green certificates subsidising this solar installation are now over. Further, the growing capacity of Belgian solar power is putting pressure on the grid during peak solar production, lowering the solar capture rate. Finally, spot prices sometimes even go negative, becoming a cost for the solar power plant owner.

As a result, monthly revenues from solar injections are sometimes down by up to 23% and there is an amount of uncertainty to be managed that has nothing to do with the core business of industrial activities.

“Our approach was to increase the flexibility of the solar power plant. We equipped the plant to intelligently control its solar injections into the grid.”

How did you adapt to this new situation?

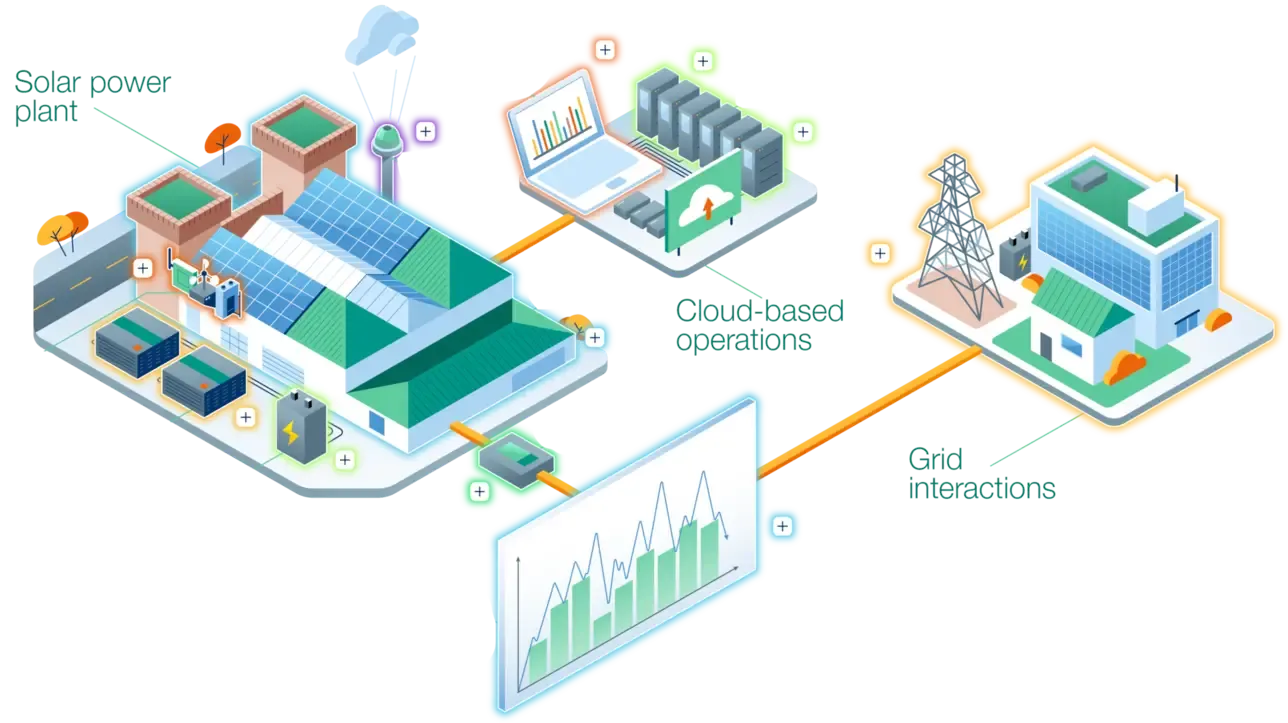

In 2024, we decided to increase the flexibility of the solar power plant in order to adjust to these new conditions. We asked solar flexibility provider Epon to equip the plant to intelligently control its solar injections into the grid.

This solution uses a network of sensors to collect, monitor and control solar injections, it forecasts both future power production and grid needs for flexibility and actively modulates inverter injections accordingly. As a result, we avoid negatives prices and generates new revenues on the imbalance price market.

This flexibility solution has the advantage of requiring very low upfront investment cost compared to the installation of battery storage capacity. Furthermore, solar injection management by Epon enables us to focus on our core business.

Now that it has been 12 months, are you satisfied with the results?

We are very happy with how things turned out. The first thing we noticed is that solar injections have been curtailed during 435 hours of negative spot prices in the last 12 months, preventing operational losses during those hours.

Furthermore, the valorisation of grid injections increased significantly, rising by 110% from 38€/MWh to 80€/MWh. This is thanks to the participation of the solar power plant in grid balancing on the imbalance price market, which generated additional returns.

Moreover, it provided the grid with 15kW of downward capacity and 138.000kWh flexible volume during peak solar production periods. Overall, 25% of solar injections were curtailed to both avoid negative spot prices and react to negative imbalance prices.

+110%

Increased value of grid injections

from 38€/MWh to 80€/MWh (+134%)

Latest case studies

Let's hear what some professionals have to say about their use of flexibility services